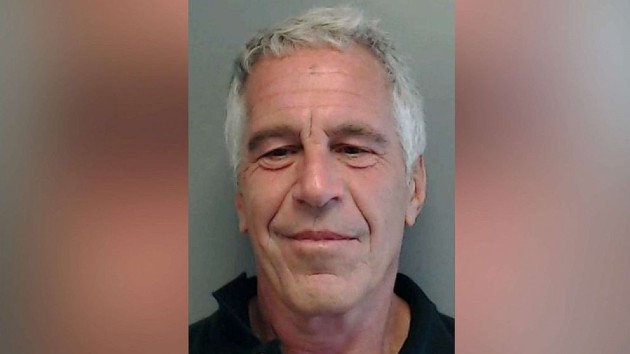

Billionaire calls relationship with Jeffrey Epstein a 'horrible mistake'

Florida Dept. of Law EnforcementBy JAMES HILL, ABC News

(NEW YORK) — Billionaire investor Leon Black addressed his prior relationship with sex offender Jeffrey Epstein during an earnings call Thursday morning for Apollo Global Management — which has $433 billion of assets under management. Black is the founder, chairman and CEO of Apollo.

On the earnings call, Black called his relationship with Epstein a “horrible mistake.”

“By nature, I am a private person, and it runs counter to my nature to speak publicly about personal matters,” Black said in opening his remarks about Epstein. “But this matter is now affecting Apollo, which my partners and I spent 30 years building. And it’s also causing deep pain for my family. Knowing all that I have learned in the past two years about Epstein’s reprehensible and despicable conduct, I deeply regret having had any involvement with him. With the benefit of hindsight, working with him was a horrible mistake on my part. I am not seeking to excuse that decision, but I do believe it may be helpful to convey some relevant facts.”

Earlier this month, The New York Times reported in a deep dive on Black’s dealings with Epstein that his relationship with Epstein went deeper than previously known, and reportedly included at least $50 million in payments from Black to Epstein and a 2012 visit by Black to Epstein’s private Caribbean island for a cookout.

That Times report, with the headline “The Billionaire Who Stood by Jeffrey Epstein,” has resulted in renewed scrutiny of Black’s dealings with Epstein and has reportedly caused some institutional investors to reevaluate or pause their investments with Apollo, according to Bloomberg and other reports.

“The existing Apollo commitments were made under the previous administration and we have no plans to commit further capital to their funds at this time. We reviewed Apollo this spring and determined, based on a variety of due diligence criteria, they did not meet our standards for making a new capital commitment,” said Gabrielle Farrell, director of communications for Connecticut State Treasurer Shawn T. Wooden in a statement to ABC News. Connecticut Retirement Plans and Trust Funds, an Apollo investor, consists of six state pension funds and nine state trust funds.

Black and some of his related family entities have also been subpoenaed for documents by the U.S. Virgin Island’s attorney general’s office, which is conducting a wide-ranging investigation of Epstein’s financial dealings and his alleged sex-trafficking scheme.

Black said he had requested that the Apollo board initiate a review of his relationship with Epstein and said an independent conflicts committee is now working on gathering information. Black said he hoped the review would be completed expeditiously and that he expects it will “assure all of our stakeholders that they have the relevant facts and demonstrate that everything I have said about my relationship with Epstein is accurate and truthful. The review is now underway, and I am cooperating fully.”

Black reiterated that Epstein and his related companies never did any business with Apollo. But he acknowledged paying Epstein millions of dollars annually for a six-year period between 2012 and 2017 for “professional services to my family partnership and related family entities involving estate planning, tax, structuring of art entities and philanthropic advice.” Black said that all of Epstein’s advice was vetted by leading law firms, accounting firms and other professional advisors.

“Let me be clear,” Black said. “There has never been an allegation by anyone that I engaged in any wrongdoing because I did not. And any suggestion of blackmail or any other connection to Epstein’s reprehensible conduct is categorically untrue.”

Black said that he first met Epstein in 1996 — long before any allegations of Epstein’s alleged sexual crimes became public — and he noted that Epstein was then advising prominent clients on estate tax matters and that his “network of relationships” included luminaries that Black admired and respected, including “several heads of state, heads of prominent families in finance, a U.S. Treasury secretary, accomplished business leaders, Nobel Laureates, acclaimed academicians and noted philanthropists.”

Black said he first became aware of the allegations against Epstein in late 2006, when it was publicly reported that state and federal authorities in Florida were investigating Epstein. He said that after Epstein got out of jail in 2009, Epstein returned to his previous financial advisory activities and “once again began working and associating with many prominent individuals, spanning the worlds of finance, academia, science, technology, philanthropy, business and government.”

“The distinguished reputations of these individuals gave me misplaced comfort in retaining Epstein’s services in 2012 for my personal estate planning, tax structuring and philanthropic advice. Like many other people I respected, I decided to give Epstein a second chance,” Black said. “This was a terrible mistake. I wish I could go back in time and change that decision, but I cannot. Had I known any of the facts about Epstein’s sickening and repulsive conduct, which I learned in late 2018, more than the year after I stopped working with him, I never would have had anything to do with him.”

Copyright © 2020, ABC Audio. All rights reserved.